Social Credit

|

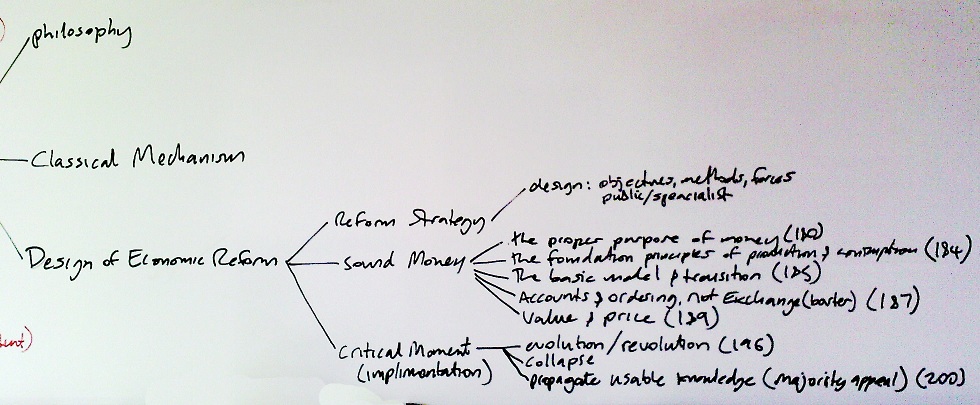

Social Credit is a socio-economic philosophy, interdisciplinary in nature, encompassing the fields of philosophy, economics, political science, history, accounting, and physics. The term Social Credit, as a formal name, originated from the writings of British engineer and originator of the Social Credit movement, Clifford Hugh Douglas (a.k.a Major Douglas, 1879–1952), who wrote a book by that name in 1924. According to Douglas, the true purpose of production is consumption, and production must serve the genuine, freely expressed interests of consumers. Each citizen is to have a beneficial, not direct, inheritance in the communal capital conferred by complete and dynamic access to the fruits of industry assured by the National Dividend and Compensated Price. Consumers, fully provided with adequate purchasing power, will establish the policy of production through exercise of their monetary vote. In this view, the term economic democracy does not mean worker control of industry. Removing the policy of production from banking institutions, government, and industry, Social Credit envisages an "aristocracy of producers, serving and accredited by a democracy of consumers". Assuming the only safe place for power is in many hands, Social Credit is a distributive philosophy, and its policy is to disperse power to individuals. Social Credit philosophy is best summed by Douglas when he said, "Systems were made for men, and not men for systems, and the interest of man which is self-development, is above all systems, whether theological, political or economic".

Quotes from the book

| A system of Society which depends for its structure on the theory of material rewards and punishments, seems to involve, fundamentally, a general condition of scarcity and discontent. | |

| — Major Douglas

|

The Nature of Money & Credit

(from Wikipedia:Social Credit)

Major Douglas also criticized classical economics because it was based upon a barter economy, whereas the modern economy is a monetary one. To the classical economist, money is a medium of exchange. This may have once been the case when the majority of wealth was produced by individuals who subsequently exchanged it with each other. But in modern economies, division of labour splits production into multiple processes, and wealth is produced by people working in association with each other. For instance, an automobile worker does not produce any wealth (i.e., the automobile) by himself, but only in conjunction with other auto workers, the producers of roads, gasoline, insurance etc.

In this view, wealth is a pool upon which people can draw, and the efficiency gained by individuals cooperating in the productive process is known as the “unearned increment of association” – historic accumulations of which constitute what Douglas called the cultural heritage. The means of drawing upon this pool are the tickets distributed by the banking system.

Initially, money originated from the productive system, when cattle owners punched leather discs which represented a head of cattle. These discs could then be exchanged for corn, and the corn producers could then exchange the disc for a head of cattle at a later date. The word “pecuniary” comes from the Latin “pecus,” meaning "cattle". Today, the productive system and the distributive/monetary system are two separate entities. Douglas demonstrated that loans create deposits, and presented mathematical proof in his book Social Credit.

Douglas believed that money should not be regarded as a commodity but rather as a ticket, a means of distribution of production "There are two sides to this question of a ticket representing something that we can call, if we like, a value. There is the ticket itself – the money which forms the thing we call 'effective demand' – and there is something we call a price opposite to it." Money is effective demand, and the means of reclaiming that money are prices and taxes. As real capital replaces labour in the process of modernization, money should become increasingly an instrument of distribution.

Douglas also claimed the problem of production, or scarcity, had long been solved. The new problem was one of distribution. However; so long as orthodox economics makes scarcity a value, banks will continue to believe that they are creating value for the money they produce by making it scarce. Douglas criticized the banking system on two counts:

- for being a form of government which has been centralizing its power for centuries, and

- for claiming ownership to the money they create.

The former Douglas identified as being anti-social in policy. The latter he claimed was equivalent to claiming ownership of the nation. Money, Douglas claimed, was merely an abstract representation of the real credit of the community, which is the ability of the community to deliver goods and services, when, and where they are required.

Concepts

- What about the workers

- p125 - democracy - how can non-specialsts make decisions

Notes

- Confusing formula on p85

See also

- Wikipedia:Major Douglas

- Books by Major Douglass at Run For Cover!

- douglassocialcredit.com

- Local PDF

- Full text online (good for linking to)

- Currency - our discussions on a proposed currency system for the network