Gold & silver

Fiat money continuously devalues in terms of it purchasing power due to the supply being inflated by government printing, and more significantly, by banks lending it into existence. Historically a sure sign of a fiat system coming to its end is the rise in price of gold as the people start to lose faith in the system and run back to something of real and stable value. However, the banks and other large players in the fiat system have figured out how to keep the price of metals severely suppressed to maintain the illusion of faith in their system. This method is not the "spoofing" of orders and other Wall Street shenanigans we see every week in the news, it's a much larger system of manipulation hiding in plain site - it's the fractional reserve bullion banking system. The amount of bullion being traded every day is more than what is mined in a year! Only a tiny fraction of the gold traded in the LBMA and COMEX markets actually exists. The bullion banking system is exactly like the fiat fractional reserve banking system causing rampant inflation through lending paper metal into existence, thus devaluing the existing real physical supply. I wonder if this is how they'll also handle Bitcoin?

Under the LBMA definition, an "unallocated" gold account is one in which the customer merely has a claim on the bullion bank account provider for an amount of gold. The bullion bank in turn has a liability to the customer for the same amount of gold. Importantly, in the LBMA system, the customer is an unsecured creditor of the bank. Gold trades are settled using the "loco London" mechanism which simply means a quoted price is for a trade which settles using unallocated gold "delivered" in London, i.e. the trade settles using the London Gold Market system of unallocated gold accounts and clears though the unallocated London Precious Metal Clearing System (LPMCL). The standard for the metal that an unallocated balance represents is theoretically defined as 995 fine gold in London Good Delivery Bar format. However, nothing is actually delivered under unallocated trading, i.e. there is no physical transfer of anything between the parties to the transaction. The transfer is merely a book entry.

| Banks treat their metal deposits in much the same way as they do deposits denominated in money, as the reserve asset against which they lend additional money to borrowers. | |

| — CPM Group |

Gold news

- 2022-06-28: Office of the Comptroller (OCC) report objectively proves big-four gold price manipulation is all true! & follow up & also see Rob interviewed about the report on LFTV

- 2021-10-20: The indelicate balance of ethics against profit - Ahmed Bin Sulayem (CEO of the DMCC)

- 2020-10-06: "The Real Move In Gold Hasn't Started Yet" - Von Greyerz Warns "System Entering Super-Exponential Phase"

- 2020-05-11: GoldSwitzerland.com: Total catastrophe of the currency system

- 2020-04-17: Oof - COMEX gold supply available for delivery is well under

- 2019-11-12: New COMEX Pledged Gold - Shrinking the Pool of Registered Inventory

- 2019-09-16: LBMA Board Member & JP Morgan Managing Director Charged with Rigging Precious Metals - and then nek minute

- 2019-09-15: Rothschild emerges from the shadows for the Centenary of the London Gold Fixing

- 2019-08-20: Another ex-JP Morgan precious metals trader pleads guilty to "spoofing" is cooperating with Feds

- 2019-03-20: Basel III - BIS upgrade gold to a 0% risk asset in preparation for next crisis

- 2015-12-24: Giant Turkey-Dubai-Iran gold scandal

- 2015-01-08: Missing piece in the gold-repatriation puzzle

- The people have been buying up all the silver coins not JP Morgan, and not gold coins

- Banks pillaged allocated gold and silver accounts

- Must money be backed by gold?

- Goldbugs vs Greenbackers (WebOfDebt) - An excellent explanation of the fallacies of the gold standard

- Geopolitics and the World’s Gold Holdings

- Against the Gold Standard

- The History of Gold and the Future of Bitcoin

- R.I.P. - The London Gold Pool, 1961-1968

- Ron Paul – “The Gold Price is Rigged by Central Banks” - with excellent sources list

Silver news

- 11 Jul 2019: A Whale Is Accumulating Silver Futures

- 11 Feb 2019: Jeff Clark Live in Vancouver: The One Reason Silver & Silver Stocks Will Explode Higher

- 10 Dec 2014: Silver is the Pressure Point Knockout! - excellent three part series

- 24 Nov 2014: The Answer to this Question Will Change Silver Forever

- 10 Nov 2014: The Most Important Question about Gold and Silver Price Suppression, Answered!

- Gold And Silver Shorts Were The Real Demise For Bear Stearns

- Ted Butler: JP Morgan’s Perfect Silver Manipulation Cannot Last Forever

- JP Morgan Holds Highest Amount Of Physical Silver In History

- Naked Gold Shorts: The Inside Story of Gold Price Manipulation

- 10 Reasons Why Gold Is The Gut Reaction And Why Silver Is The Smart Decision - and another copy with more links here

Sites about gold and silver

- Hidden Secrets of Money by Mile Maloney at GoldSilver.com

- Gold University at BullionStar.com

- Zero Hedge

- Silver Doctors

- Silver Bullet Silver Shield

- Gold Silver Worlds

The Wealth Watchman

See also

- Bullion-banking mechanics

- About the LBMA

- Sovereign Man on gold ETF's

- TF metals report

- Gregor Gregersen - Offshore Gold Storage: Are You An Owner Or A Creditor?

- Ouro Absoluto - buy gold online in Brazil at global bullion price

- Money

- Which gold-backed token is best for you?

- Crypto-currencies

- The global elite

- Oil

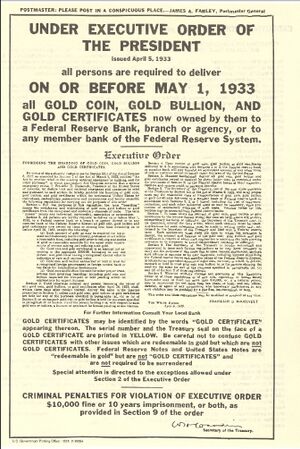

- How did the 1933 gold confiscation play out?