Difference between revisions of "Bitcoin"

(Fiat Leak] - realtime map showing fiat currencies moving in to the Bitcoin economy) |

(why not gold?) |

||

| Line 29: | Line 29: | ||

The Bitcoin value will continue to increase rapidly while it is extending into new markets, but its growth will slow down as its share in these markets reaches a point of equilibrium with the other competing technologies and financial instruments in those markets. Currently it's value is around $700 which equates to a total market capital of about ten billion dollars, but has not yet begun to really take off in many markets that it is very well suited to such as banking and escrow services, smart contracts and other high-level financial instruments. There are also other technologies outside the financial arena which Bitcoin has given rise to which are likely to help grow the network such as private communications and distributed user authentication. Even fairly conservative analysis yields a very high likelihood that a few more years down the track the Bitcoin economy will be in the trillion dollar scale, which puts the individual coin value into the tens or even hundreds of thousands of dollars. | The Bitcoin value will continue to increase rapidly while it is extending into new markets, but its growth will slow down as its share in these markets reaches a point of equilibrium with the other competing technologies and financial instruments in those markets. Currently it's value is around $700 which equates to a total market capital of about ten billion dollars, but has not yet begun to really take off in many markets that it is very well suited to such as banking and escrow services, smart contracts and other high-level financial instruments. There are also other technologies outside the financial arena which Bitcoin has given rise to which are likely to help grow the network such as private communications and distributed user authentication. Even fairly conservative analysis yields a very high likelihood that a few more years down the track the Bitcoin economy will be in the trillion dollar scale, which puts the individual coin value into the tens or even hundreds of thousands of dollars. | ||

| − | However, there is also a risk because there are definitely a number of things that could go wrong causing the system to fail and loose all its value very quickly. For example, a flaw in the code being discovered and exploited, the mining operations being bribed or taken over, it could be made illegal etc. I personally believe that since these things have all been tried extensively and it's survived all attacks so far, the chances are good that it will thrive for at least a few more years yet, but I could be wrong. My advice to anyone heavily invested in it is to sell a portion of your Bitcoins and buy silver and/or land with the money - a portion that equates to a good overall return on your investment, but still leaves you with a reasonable stake in the Bitcoin economy. | + | However, there is also a risk because there are definitely a number of things that could go wrong causing the system to fail and loose all its value very quickly. For example, a flaw in the code being discovered and exploited, the mining operations being bribed or taken over, it could be made illegal etc. I personally believe that since these things have all been tried extensively and it's survived all attacks so far, the chances are good that it will thrive for at least a few more years yet, but I could be wrong. My advice to anyone heavily invested in it is to sell a portion of your Bitcoins and buy silver ([http://www.thepeoplesvoice.org/TPV3/Voices.php/2011/08/09/10-reasons-why-gold-is-the-gut-reaction- why not gold?]) and/or land with the money - a portion that equates to a good overall return on your investment, but still leaves you with a reasonable stake in the Bitcoin economy. |

=== Why is Bitcoin important? === | === Why is Bitcoin important? === | ||

Revision as of 14:09, 7 December 2013

Bitcoin is an open source peer-to-peer (P2P) electronic cash system that's completely decentralised, with no central server, trusted authorities or middle men. The availability of bitcoins can't be manipulated by governments or financial institutions.

Bitcoin is the first truly decentralised currency and has paved the way for hundreds more to compete together in Cipherspace over the coming years. This is one of the key factors in the transition of global society into the post-nation-state economy talked about in books like The Sovereign Individual and which is coming to be known by agorists as The Second Realm.

If you have a bitcoin, what that means is that there is an agreement among its users that the world owes a certain amount of labor to you. The value of the bitcoin approximately depends on the size of the network, and essentially gives you a 1 / 21000000 share in the value that can come out of this network and its ability to facilitate trade. When gold was the dominant currency, it seemed that it represented physical value while bitcoin is a looking glass that shows us what money really is: social value.

Bitcoin is the first online currency to solve the so-called “double spending” problem without resorting to a third-party intermediary. The key is distributing the database of transactions across a peer-to-peer network. This allows a record to be kept of all transfers, so the same cash can’t be spent twice–because it’s distributed (a lot like BitTorrent), there’s no central authority. This makes digital bitcoins like cash dollars or euros: Hand them over directly to a payee, and you don’t have them anymore, all without the help of a third party.

A couple of good introductions to bitcoin are this one by Bitcoin Weekly and this one by Bitcoin Bytes.

Contents

- 1 Organic Design statement on Bitcoin

- 2 How it works

- 3 How to use it

- 4 The Bitcoin Wallet

- 5 Related news

- 6 Other sites about Bitcoin

- 7 Bitcoin statistics and charts

- 8 Bitcoin exchange sites

- 9 Bitcoin Stock Exchanges

- 10 Work for Bitcoins

- 11 Mining Bitcoins

- 12 Extending Bitcoin functionality

- 13 The 21 Million Coin Limit

- 14 Inflation and Transaction Fees

- 15 Criticism

- 16 Further reading on bitcoin's value

- 17 Economics & Liberty articles

- 18 Related projects

- 19 Various commentators on Bitcoin

- 20 Interesting articles about Bitcoin

- 21 See also

- 22 Subpages

- 23 Attachments

Organic Design statement on Bitcoin

Over the last few months Bitcoin has been receiving a lot more attention from the mainstream media and is in fact starting to become a mainstream service in many ways. This has been causing the price to rise a lot which in turn has been leading to a lot of heated debate on both the positive and negative side. Organic Design fully supports Bitcoin and the entire cryptocurrency movement, and has therefore been receiving some negative feedback from those who feel that Bitcoin is not a solution, is not "sound money", is "just another fiat currency" or is a "bubble" that will crash at any time. I'll address each of these issues in this section, and conclude with the positive side; why Bitcoin is so important and so deserving of full support.

Fiat currency

Bitcoin certainly doesn't fit the classic definition of "sound money" and does fit most definitions of a fiat currency (a currency that's not backed by anything). However this is a new age, and in many ways the old rules and definitions don't apply here. The main reason that fiat currencies are considered to be a problem and need to be backed by something tangible is that the issuing authority cannot be trusted, and corruption inevitably seeps in and leads to inflation and deflation in order to control the people and benefit the few who control the issuing authority.

It is believed that by backing the money with a commodity of intrinsic value such as gold or silver will prevent this problem, but the reality is that gold and silver can also be heavily manipulated by those in power. In fact gold and sivler are being manipulated to the most extreme degree ever known right now in order to help prevent the US dollar from collapsing, that's why we're seeing both extremely low prices as well as an unprecedented demand at the same time.

But in the case of Bitcoin, there is no need to resort to this form of protection from the fraudulent issuing authority because there is no central authority in control of issuance. So yes Bitcoin can be considered a fiat currency, but it does not suffer from the problem that all other fiat currencies suffer from. Decentralisation is the real solution to the problem, backing the currency with commodities of value is not a complete solution because it doesn't address the core of the problem which is that centralised systems are prone to corruption.

Price instability

Bitcoins unstable price prevents it from being considered as sound money. The way Bitcoin is intended to be used in the sense of a currency is as a medium of exchange, users hold their wealth in the currencies or commodities of their choice, and then when they want to pay someone else, they can convert the required amount of currency to Bitcoin and pay the recipient anonymously and privately with full confidence that they'll receive their value in an unforgeable and irreversible way, regardless of whether they're trustworthy or where in the world they're located. The receiving party can then immediately convert their payment to the currency or commodity of their choice if they're unwilling to expose themselves to the volatile nature of the Bitcoin price making that volatility totally irrelevant for everyday use.

Trading with others around the world with total privacy and security is an extremely valuable service in an age where practically everything you do is being monitored, and most especially things of a financial nature since there may be taxes due on them. Many people have recognised that a monetary system free from authoritarian scrutiny is a very valuable service, and this fact combined with the limited supply of Bitcoins creates an increasing demand for them. The more businesses and services that build up on top of the basic Bitcoin functionality, the larger the Bitcoin economy grows and the more valuable the coins become.

A Bitcoin can be seen not only as a medium of exchange, but also as a share in the Bitcoin economy. As stated above, the actual value of the coins makes no difference to the way Bitcoins are used in day to day payments between peers, but the increasing value does add the extra incentive for users to save their coins since they know that their value will appreciate over time. This leads some to believe that this saving incentive is a problem because it leads to less and less Bitcoins in circulation, but since the coins are effectively infinitely divisible, the amount of Bitcoins available in circulation doesn't affect the ability for trade to continue, it just effects its exchange rate with real-world commodities and currencies.

Is it a bubble?

The Bitcoin value will continue to increase rapidly while it is extending into new markets, but its growth will slow down as its share in these markets reaches a point of equilibrium with the other competing technologies and financial instruments in those markets. Currently it's value is around $700 which equates to a total market capital of about ten billion dollars, but has not yet begun to really take off in many markets that it is very well suited to such as banking and escrow services, smart contracts and other high-level financial instruments. There are also other technologies outside the financial arena which Bitcoin has given rise to which are likely to help grow the network such as private communications and distributed user authentication. Even fairly conservative analysis yields a very high likelihood that a few more years down the track the Bitcoin economy will be in the trillion dollar scale, which puts the individual coin value into the tens or even hundreds of thousands of dollars.

However, there is also a risk because there are definitely a number of things that could go wrong causing the system to fail and loose all its value very quickly. For example, a flaw in the code being discovered and exploited, the mining operations being bribed or taken over, it could be made illegal etc. I personally believe that since these things have all been tried extensively and it's survived all attacks so far, the chances are good that it will thrive for at least a few more years yet, but I could be wrong. My advice to anyone heavily invested in it is to sell a portion of your Bitcoins and buy silver (why not gold?) and/or land with the money - a portion that equates to a good overall return on your investment, but still leaves you with a reasonable stake in the Bitcoin economy.

Why is Bitcoin important?

Bitcoin is far more than just a new secure medium of exchange, I believe it really is a paradigm shift for the whole net of a similar scale to what the invention of the web-browser was. Bitcoin isn't perfect, the mining aspect is very resource intensive and is a weak point since its very centralised, but it's opened up a whole new field of potential in the net and is an important milestone for freedom and privacy.

Many new applications are now beginning to take form, some of them like Ripple are currencies which solve some of the problems Bitcoin is seen as having. Others offer completely new features such as Namecoin which uses the Bitcoin code to make a replacement to the domain name system that's free from centralised authority, or Keyhotee which allows users to authenticate themselves to other websites without needing to trust any other site or authority with their personal information or passwords. Our own project Bitgroup is based on the technology and aims to be a social network and group-ware application that doesn't require and central server to operate.

For us at Organic Design the Bitcoin technology makes the whole vision possible. The Organic Design vision is built upon the ability for groups to work and trade together in private trust groups which together form the platform network. The problem that prevented us from moving forward with our vision was that we couldn't figure out how to implement many of the low-level details involved in trading and authentication in a peer-to-peer network. Bitcoin has solved these problems and made our project and many others possible in the process. Following is a comment from our 7 June 2010 news item which is when we first heard about Bitcoin.

| Bitcoin may last for years and become a popular global currency, or it could be just a flash in the pan, but either way I think this is an important sign of the times to come. This is one of the first truly decentralised currencies and has paved the way for hundreds more to compete together in the new arena of Cipherspace over the coming years. This is one of the key factors in the transition of global society into the post-nation-state economy talked about in The Sovereign Individual. | |

| — Organic Design, 2010 |

How it works

In a p2p computer network there are no servers, the entire network is composed of users running instances of the application on their computers. Each running instance offers a small amount of processing and storage resource to the network so that it can deliver the services it was designed for such as redundant storage, anonymity or voice-over-IP applications.

In the case of a p2p currency system, some of the services the network is designed to offer are privacy, verification, authentication, currency creation and transfer of ownership. To ensure a reliable and tamper-proof system requires a lot of resource, and that amount is proportional to the amount of coins in the network. The network is able to pay the users for the resource they offer by making the coin-creation process part of the network protocol itself instead of being handled by a central trusted authority. This creates a natural and incorruptible link between the supply of currency in the network and the demand for it.

Even aside from the ability to exchange bitcoins for other currencies, it still makes a very useful tool for independent organisations and groups because it allows them to trade and settle accounts amongst themselves independently and privately. It effectively gives them a "bank" that has a trustworthy system of accounts that can't be tampered with and requires no corruptible central authority to operate. See the following links for more detailed information about how it works.

- The Bitcoin Whitepaper - the original paper by Satoshi Nakamoto

- Video about how it works for beginners

- Bitcoin - P2P currency for Bezadis - good Prezi about bitcoin

- Bitcoin Weekly's "What Bitcoin Is"

- Bitcoin! - The Freedomain Radio Interview - Stefan Molyneux, host of Freedomain Radio, interviews Bruce Wagner about the latest and greatest currency technology in the world!

- What Bitcoin Is, and Why It Matters - article in Technology Review, published by MIT press

- What is Bitcoin? (YouTube)

- Stefan Molyneux on RT: Bitcoins: digital currency of the future? - a very nice layman's explanation of Bitcoin

- How Bitcoin works under the hood

Bitcoin was born on January 3rd, 2009, at 6:15PM Greenwich Mean Time, which is when Satoshi Nakamoto mined the first 50 coins, known as the "genesis block."

How to use it

After you've installed the bitcoin applicaton on you computer and run it, you'll see a simple application window with six tabs across the top which ara each explained as follows:

Ovreview: this is the default tab and gives you a basic summary of your confirmed and unconfirmed (by other nodes in the network) balance, and a list of the last few recent transactions.

Send coins: this allows you to send bitcoins to any number of recipients. For each recipient you enter an amount to send them, and their bitcoin address with an optional name for you to remember the address by. You can also select the address from your "address book" which is a list of all the addresses you've given a name to. There's an "Add Recipient" button at the bottom for adding more recipients to send to at the same time.

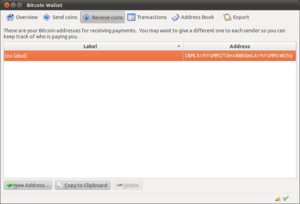

Receive coins: this a list of your bitcoin addresses that other people can send coins to. The sender is anonymous, so you can use these named receiving addresses to kepp track of where your coins have come from by telling each contact a specific address to send to. You can create as many receiving addresses as you like using the "New Address" button at the bottom.

Transactions: this tab is a simple list showing all your transactions with you can filter by amount sent or received, and by period. Each item in the list shows the date/time of the transaction, your local name for the address the transaction was received with or sent to, and the amount in bitcoins.

Address Book: this is a list of the addresses you've created for sending bitcoins to and the local name you've chosen for each address. You can edit or delete each address by right-clicking on it, and you can add new addresses with the "New Address" button at the bottom (which is the same as useing the "Add Recipient" button in the "Send Coins" tab.

Export: this a button that brings up a file-save window to export the data shown in the currently selected tab. This button can't be used if the "Overview" tab is selected since it only works for the tabel-data in the other four tabs.

When the application is started for the first time (or after a few days or more of disuse) there is a long delay while your instance of the application synchronises its local data with the current state of the network. This is very computationally intensive and can take many hours. Your displayed balance may be incorrect until its fully sycnhronised, but you can still send coins from out of the currently confirmed coin-balance. You can never spend any coins you don't have because the locally out-of-date information only applies to incoming transactions, because all outgoing transactions are done locally.

The Bitcoin Wallet

The term "wallet" is actually a little bit missleading because the information representing coins and transactions are actually stored throughout the entire network, not in the wallets. The wallet actually stores private keys that give the wallet-holder the ability to spend coins in the network that are confirmed as being currently associated with one of your private keys. A bitcoin address that you show to other people in order for them to send you money is the public half of one of the private keys in your wallet.

This means that it's very important to back up your wallet and to remember the password you've locked it with, because if you lost access to your wallet you'd no longer have control over any of the coins in the network that are associated with your addresses. You must back up your wallet whenever you create a new address, but there's no need to back up your wallet every time you receive new coins, because these are not stored in your wallet. For example, you could have a bitcoin wallet on a computer that's never been connected to the network and be paid into that wallets address for years before you got around to connecting it and checking your balance.

- Securing your wallet

- Wallet do's & don'ts

- Paper wallet - how to store your wallet information on paper

- MultiBit.org - secure, lightweight, international Bitcoin wallet for Windows, MacOS and Linux

- Tor Wallet - TORwallet is an online bitcoin wallet run as a TOR hidden service

Migrating your wallet from Bitcoin-qt to Multibit

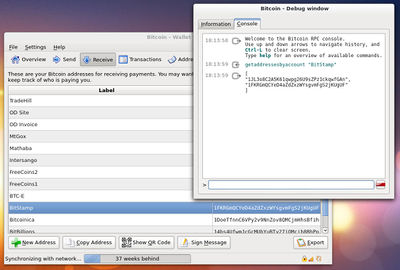

This procedure is explained very well here, but it does miss out one very important point which can lead to a lot of balance missing after Multibit has finished synchronising (don-t worry though, it's not missing irreversibly!). The problem is that when you go through the process of getting the private key for each of your addresses and adding them to the file you're going to import into Multibit, you may be missing some hidden addresses that have been used for receiving change. These addresses are in your wallet, but are not listed in the interface. So my instructions following are based on the preceding link, but work based on your account labels instead of the addresses, you can then do an additional command to list all the addresses within each label which includes the hidden "change" addresses. The screenshot shows the process being performed on the "Bitstamp" receiving address, you can see that the interface shows only one address, but the console has listed two (you can click on it to see a full size version).

Related news

- 06 Dec 2013: This Is, Quite Simply, The Biggest Endorsement That Bitcoin Has Ever Received

- 06 Dec 2013: China bans banks from handling Bitcoin trade

- 27 Nov 2013: BTC over $1000 today!!!

- 23 Nov 2013: Bitcoin Tops PayPal For First Time in Total Transactions

- 17 Nov 2013: BTC hit $500 today!!!

- 13 Nov 2013: BTC over $400 today!

- 07 Nov 2013: BTC over $300 today!

- 04 Nov 2013: BTC China beats Mt. Gox and Bitstamp to become the world’s No.1 bitcoin exchange

- 15 Oct 2013: China's Google Is Now Accepting Bitcoin

- 08 Aug 2013: Court officially declares Bitcoin a real currency

- 29 Jul 2013: Thailand bans using Bitcoin in any way, local startup reports

- 03 Jul 2013: Gox sanctioned - banks disable payments to and from Gox

- 20 Jun 2013: Mt Gox Halts Run on USD as Market Share Falls to New Low

- 28 May 2013: At This Rate, The Last New BTC Will Be Issued 15 to 55 Years Ahead Of Schedule

- 17 May 2013: "Non-political" Bitcoin is "like internet – can't be put away easily"

- 26 Apr 2013: Bitcoin: world's fastest growing currency migrates off the internet

- 18 Apr 2013: Bitcoin-24's bank account frozen by German authorities

- 10 Apr 2013: Bitcoin Suffers A Correction Amid Apparent DDOS Attacks On Some Exchanges

- 10 Apr 2013: Major BTC collapse today from $266 down to $90!

- 09 Apr 2013: BTC over $200 today!

- 01 Apr 2013: BTC over $100 today!!!

- 31 Mar 2013: Challenging the dollar: Bitcoin total value tops $1 billion

- 28 Mar 2013: BTC over $90 today

- 26 Mar 2013: Bitcoin on BBC Newsnight

- 26 Mar 2013: BTC over $80 today

- 24 Mar 2013: Bitcoin Privacy Extension to Have Backdoor for Government Snooping?

- 21 Mar 2013: BTC over $70 today

- 20 Mar 2013: Fleeing the Euro for Bitcoins

- 20 Mar 2013: BTC over $60 today

- 19 Mar 2013: Is Bitcoin the New Safe-Haven Currency? Bitcoins Surge After Cyprus Bank Raid

- 19 Mar 2013: FinCEN sounds death knell for US based Bitcoin businesses

- 18 Mar 2013: BTC over $50 today!!! - probably jumped up a bit due to the Cypress drama

- 12 Mar 2013: Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23%

- 05 Mar 2013: BTC over $40 today

- 01 Mar 2013: BTC over $35 today

- 21 Feb 2013: BTC over $30 today

- 12 Feb 2013: BTC over $25 today

- 07 Jan 2013: BitPay Banks $510K In Investment To Become PayPal for Bitcoin, Already Has 2,100 Businesses On Board

- 07 Dec 2012: Bitcoin exchange gains clearance to operate as a real bank in France

- 28 Nov 2012: The block completion reward halved to 25 BTC today.

- 14 Oct 2012: More surreal events in the Crypto Cold War - the BitCoin blockade of Iran

- 02 Sep 2012: Bitcoin alive and here to stay, or slowly fading away?

- 20 Aug 2012: Plummeted all the way down to about $7.50, then quickly bounced back to a stable $10

- 17 Aug 2012: BTC hit $15 today

- 16 Aug 2012: Trading Bot Runs Amok on MtGox

- 08 Aug 2012: My Answer To A VC's Bitcoin Question - Forbes

- 02 Aug 2012: BTC just went over $10!

- 11 JUl 2012: Paypal’s Abandonment of Major Cyberlockers May Become Bitcoin’s Big Win

- 29 Jun 2012: Betting on Bitcoin: Coinbase Wants to Be the PayPal of Internet-Only Currency

- 26 Jun 2012: BitPay Shatters Record for Bitcoin Payment Processing

- 22 Jun 2012: The Bitcoin Richest: Accumulating Large Balances

- 19 Jun 2012: TORwallet Sparks Trust Without Jurisdiction Debate

- 18 Jun 2012: Are Bitcoins Becoming Europe's New Safe Haven Currency?

- 13 Jun 2012: Why Apple Is Afraid Of Bitcoin

- 12 Jun 2012: Bitcoin, the City traders' anarchic new toy

- 04 Jun 2012: Banks get ready for virtual cash

- 14 May 2012: Bitcoinica site breached

- 09 May 2012: FBI release a report on how Bitcoin works

- 21 Apr 2012: Bitcoinica Registers in New Zealand for Bitcoin Margin Trading

- 24 Sep 2011: Developers of the crypto-currency are designing initial support for multi-transactions - Multi-transactions allow the possibility of ‘contracts’.

- 16 Aug 2011: TradeHill: USD Domestic and International Wire Transfers are Available Again

- 22 Jun 2011: EFF backs away from Bitcoin

- 20 Jun 2011: True News: Vancouver Riots, Greek Austerity & Bitcoin Thefts

- 19 Jun 2011: DailyTech: Inside the Mega-Hack of Bitcoin: the Full Story

- 23 Jun 2011 a more accurate telling of the hack

- 17 Jun 2011: Symantec Uncovers Bitcoin-Stealing Trojan

- 16 Jun 2011: Bitcoin theft: half a million dollars gone?

- 14 Jun 2011: True News: Bitcoin, Free Markets and Economics 101

- 12 Jun 2011: guardian.co.uk - Bitcoin: the hacker currency that's taking over the web

- 07 Jun 2011: Bitcoin Triples Again

- 06 Jun 2011: IT staffer installs bitcoin miner on ABC's servers

- 03 Jun 2011: New Decentralized Currency Stimulating Underground Barter Economy

- 04 May 2011: Bitcoins Beat the Bankers – Webs First Peer-to-Peer Bitcoin Crypto Currency Empowers Users, May Replace Banks

- 30 Apr 2011: CoinPal gets shut down

- 23 Mar 2011: Google engineer releases open source Bitcoin client

- 20 Jan 2011: EFF calls Bitcoin a Step Toward Censorship-Resistant Digital Currency

- 07 Jun 2010: Our local news item introducing Bitcoin

Other sites about Bitcoin

- BitcoinFilm.org - a short documentary about Bitcoin in Argentina

- The Bitcoin List

- Bitcoin Magazine - excellent articles on Bitcoin

- Bitcoin Bytes

- The Bitcoin Review

- Bitcoin.org

- BitcoinMe.com

- MyBitcoin.com - an easy to use online Bitcoin interface and free shopping cart for websites

- Bitcoin wiki - a MediaWiki for Bitcoin

- Bitmit - an online auction using bitcoin for the currency

- Bitcoin Wiki - Trade page which lists services that accept Bitcoin

- Cash n' carry Bitcoin

- BitcoinWeekly.com

- We Love Bitcoins

- List of Major Bitcoin Heists, Thefts, Hacks, Scams, and Losses

- AmpedMarket - a secure, anonymous marketplace integrated with the Bitcoin currency base on BitWasp

- BitPay - the "PayPal" of Bitcoin?

- Coinbase

- BitcoinStarter.com

- Coin Market

- btcwire - the bitcoin wire protocol package from btcd

Bitcoin statistics and charts

- BlockChain.info - charts and statistics for the whole bitcoin economy

- BitcoinWisdom - awesome chart service covering many currencies and exchanges

- Bitcoinity - excellent real-time price charts

- World map of recent transactions

- Global Bitcoin Nodes - graphical display of the distribution of nodes

- Coinometrics - really high-level analysis of the bitcoin economy

- MtGox Live

- Bitcoin Watch

- List of important events in the Bitcoin network

- Mt Gox lag charts

- Fiat Leak - realtime map showing fiat currencies moving in to the Bitcoin economy

Bitcoin exchange sites

Buying Bitcoins is more difficult than expected considering that there's so many people trying to buy them. The reason is because Bitcoins more closely resemble cash than they do credit. This is because the transactions are irreversible whereas credit cards, Paypal and many other electronic forms of credit can be reversed up to six months later. To make matters worse, PayPal and most credit card company's have reversed many Bitcoin transactions because they consider Bitcoin to be a fraudulent operation. So the bottom line is that buying Bitcoins needs to be done with a solid irreversible form of currency such as cash in person or posting a cheque. Following are some exchanges offering various means of buying and selling Bitcoins. I find the easiest method is to use a wire transfer from a bank account which many exchanges accept (even though wire transfers can actually be reversed, but it's quite a procedure).

- Intersango - (based in London) allows international wire to deposit funds into EUR, GBP or PLY

- Bitstamp - (based in Slovenia) allows international wire in USD and a few other currencies

- Bitcoin-24.com - no BTC transfer fees, only $3.20 international wire fee, no ID for signup, based in Britain, accounts in Poland

- MtGox - (based in Tokyo) extremely strict signup & verification procedures

- BTC-e - (based in Russia) allows international wire in USD and a few other currencies, minimum US$5000 (also handles Namecoin, Litecoin and others)

- BTC China - doesn't currently have wire transfer option, support liberty reserve and Chinese payment systems

- IMCEX - a user-to-user Bitcoin, Namecoin and LibertyReserve exchange

- BitInstant - Providing instant transfers for the bitcoin economy

- bitcoin.de - German exchange

- BitNZ - New Zealand exchange

- BitFloor - US-based exchange focussing mainly on US users

CampBX- requires Dwolla to use which is only available to US employees (citizens)Crypto X Change- (based in Australia) does not allow international wire transfersBitcoinica- hacked and died May 2012TradeHill.com- shutdown late 2011- GoldSilverBitcoin.com - buy metals with btc

- Forex meets Bitcoin exchange - release the Kraken!

- Moneero Social - send Bitcoins to anyone on email or social networks

- BitQuick - escrow based system allowing direct connection to your bank account, 2% fee

- Brascoins - a Brazilian bitcoin exchange

Bitcoin Stock Exchanges

GLBSE.com- the Global Bitcoin Stock Exchange- MPEx Bitcoin stock exchange

- ICBIT Bitcoin stock exchange

- Stock Exchanges Category at bitcoin.it

- The Bitcoin Stock Market - Miners and Pirates, Oh My!

Work for Bitcoins

Mining Bitcoins

- Bitcoin mining guide

- Mining hardware comparison

- FPGA vs GPU

- LinuxCoin wiki

- A noob's experience of mining with a BFL Jalepino

Extending Bitcoin functionality

Bitcoin could become a multipurpose network by adding additional information to coin blocks, for example NameCoin extends the network to provide a distributed DNS alternative. Similar things could be done to provide distributed authentication and a distributed ontology for shared knowledge and organisation.

- How to make a distributed escrow service - a comment by Satoshi Nakamoto in 2010 from the Bitcoin forum

- Open Transactions - this is being designed to work as the escrow/banking layer using BTC as its reserve currency

- The Network - the p2p network we're architecting

- Improvement proposals

- Smart property - could also be used to track 'true-cost' accounting and price discovery!

- Distributed contracts

- Bitbills - the first and only bitcoins in physical form.

- BitcoinX - extending the blockchain to exchange many asset types using coloured coins

- btcwire - the bitcoin wire protocol package from btcd

- BitMessage - uses blockchain technology to create a p2p messaging system

- BitcoinStarter - Kickstarter for the Bitcoin world

- PeerCover - Bitcoin-based insurance project at BitcoinStarter]

Bitcoin Set To Unleash Massive Tsunami Wave Of New Development With New Features

Bitcoin will be more than a currency if multi-transactional features are added to the core code. Right now the developers of theCryptocurrency are designing initial support for new types of transactions. What are multi-transactions? Multi-transactions allow the possibility of ‘contracts’. According the [Bitcoin Set To Unleash Massive Tsunami Wave Of New Development With New Features wiki], “A distributed contract is a method of using Bitcoin to form agreements with people via the block chain. Contracts don't make anything possible that was previously impossible, but rather they allow you to solve common problems in a way that minimizes trust.” This means services based on cryptographic trust are now possible that was previously only possible with paper, pen, and a line to sign. The new possible services that could be developed include escrow services, secured deposits, dispute mediation, assurance of goods, smart property, etc. These features would eliminate the need for paper contracts in many different industries. In addition to banking, currently existing sectors that could be affected include title companies, lending services, billing services, ownership of anything digital (cars, phones, computers), home loans, car loans, funding services, etc. The cost of creating these contracts in bitcoin will be practically zero. (more...)

The 21 Million Coin Limit

Many people are concerned about this "21 million coin limit" for example this blog post about Why Bitcoin Will Fail as a Currency is based on this belief. But it's not actually a problem because Bitcoins are divisible into eight decimal places (and future versions of the protocol could easily be designed to divide it further if there becomes demand for that) so even if there were only a few Bitcoins in existence, the entire Bitcoin economy could still operate properly.

Inflation and Transaction Fees

By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.

The incentive (for nodes to support the network) can also be funded with transaction fees. If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.

Criticism

The following links suffer from dubious credibility, bearing hallmarks of poor writing and fuzzy understanding of cryptography, economics and monetary terminology and concepts. Nevertheless, they point out some useful and interesting information:

- Bitcoin equals World of Warcraft without the fun (and how to fix it) - Some insightful and some perhaps not-so-insightful thoughts...

- Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency - Volatility of BitCoin/USD exchange rates. Caveat: the writer misunderstands and misapplies the terms 'inflation' and 'deflation' (which are effects of change in money supply) - as an explanation for BitCoin's recent volatility. Clearly volatility is a result of speculation - changing demand for a nearly constant supply. The money supply of BitCoin is inherently asymptotic.

Further reading on bitcoin's value

- The clear divisions on Bitcoin - Blogdial, June 22, 2011

- Another Take on Bitcoins - Gary Kinghorn, June 22, 2011

- A Bit of Sound Money: Free Banking or 100% Reserve Banking - Theodore Phalan, June 21, 2011

- Bitcoin's Value is Decentralization - Paul Bohm, June 17, 2011

- The Economics Of Bitcoin – Why Mainstream Economists Lie About Deflation, Michael Suede, June 11, 2011

- Bitcoin and the Denationalisation of Money - C. Harwick, June 8, 2011

Economics & Liberty articles

- Bernard Lietaer's "Internet Currencies for Virtual Communities"

- The Real Problem With Digital Currencies and Privacy - by Anthony Freedman

- Further Observations on Bitcoin, Digital Currencies, Privacy and Liberty - by Anthony Freedman

- The Coming Attack On Bitcoin And How To Survive It - by Anthony Freedman

- The Economics Of Bitcoin – Challenging Mises’ Regression Theorem - by michaelsuede

Related projects

- NameCoin

- Namecoin SPA

- SolidCoin

- Litecoin

- NodeBitcoin - Communicate with bitcoind via JSON-RPC

- BitWasp - anonymous bitcoin marketplace built for use in conjunction with hidden services such as .onion websites and eepsites

- Open Transactions

- PPCoin

- LiteCoin

- Bitcoin 2.0? - Jed McCaleb's initial post about Ripple, more here

- Cryptfolio - keep track of your cryptocurrencies securely and stay updated with your online securities and funds

- Gliph - Secure Texting + Bitcoin Payments

- MasterCoin

- DAC - Digital Autonomous Corporations

Various commentators on Bitcoin

- Max Keiser - Bitcoin: Currency of Resistance

- Cliff High podcast on Bitcoin - March 2013

- Daily Reckoning - Daily Reckoning on BitCoin

- SovereignLife on Bitcoin

- BBC item on Bitcoin

- Keiser Report on Bitcoin

- A computer scientist and a gold bug analyses Bitcoin

- Why Are Libertarians Against Bitcoin?

Interesting articles about Bitcoin

- The Daily Value Of Bitcoin Transactions Has Passed Western Union's And It's Catching Up To Paypal's

- 10 Reasons Why The Value Of Bitcoin Is Skyrocketing

- Why You Should Care About Bitcoin - money is going digital and it is impacting the biggest growth industry of the past 75 years

- Why won’t Bitcoin die? - The virtual currency has had many near-death experiences in its short four year life, but it just keeps bouncing back

- DEFCON 19: Hacking the Global Economy with GPUs - or How I Learned to Stop Worrying and Love Bitcoin - very informative talk about recent Bitcoin events

- Cleaning up the Bitcoin act

- The 10 Most Anticipated Bitcoin Projects for 2012

- The History of Gold and the Future of Bitcoin - "if the subjective theory of value means anything, 'unique cryptographic hash' is not inherently less valuable than 'shiny rock', even if it has no representation in physical space. Each has only the value that people give to it."

- Will Draconian Controls Drive Bitcoin Adoption?

- Engineering the Bitcoin Gold Rush - an Interview with Yifu Guo, Creator of the First ASIC-Based Miner

- The Eye of Sauron Has Spotted Bitcoin

- The future of Bitcoin - excellent article on the past and future of bitcoin as of 2013

- Barons of Bitcoin: the Tokyo-based powerhouse that controls the world's virtual money

- Bitcoin Lied, Confirmed Transactions Died - all about the blockchain fork that occurred between versions 0.7 and 0.8

- Why do VC's care about Bitcoin?

- Bubble or No, This Virtual Currency Is a Lot of Coin in Any Realm

- Bitcoins or Gold?

- WeBank - Report organised by Nesta and OpenBusiness.cc about P2P finance

- Bitcoin's Liquidity: A Third Look

- How to counterfeit Bitcoins - not!

- Bitcoin - Cyber Death of the Banking Industry

- I Tried Hacking Bitcoin And I Failed - Dan Kaminsky on Bitcoin

- The Great Gold vs Bitcoin Debate: Casey vs Matonis

See also

- What Happens When ANONYMOUS Gets A Bank?

- The War on Digital Currency

- FellowTraveler on Github - developer of Open-Transactions (bitcoin / voucher-safe integration)

- AgoristRadio.com w/ Justin of Voucher-Safe - Bitcoin & Voucher-safe

- libbitcoin - a bitcoin library targeted towards high end use. The library places a heavy focus around asychronicity.

- Bitcoin Isis portal on Osiris

- Alan Szepieniec Presents Bitcoin at Polish Mises Institute - In a step ahead of their U.S. namesake, the Polish Ludwig von Mises Institute hosted Alan Szepieniec to present bitcoin during the 2011 Summer Seminar in Warsaw.

- Must money be backed by gold?

- Peer to peer

- Using MultiBit to buy online with a Bitcoin swatch

- Bitcoin cash-mobbing

- Tonika - social routing with organic security

- Random numbers, Encryption and Hashing

- How Digicash blew everything

- Wikimedia's lame reason for not accepting bitcoin

- Pirate?

- transactions to our address

- Bitcoin card

- Bitcoin Privacy Extension to Have Backdoor for Government Snooping?

- Online transaction systems

- Money

- Cryptocurrency

- Digital economy