The financial system

Contents

- 1 Yes, Banks DO Create Money Out Of Thin Air!

- 2 Why is this money-out-of-thin-air fact so important?

- 3 More quotes about the financial system

- 4 The Nature of Money & Credit

- 5 Monetary reform

- 6 The Problem of Usury

- 7 Distribution of Wealth

- 8 Internal Memo from the Bank of England 1862 to the Banks of America

- 9 BRICS & SCO

- 10 Related news & views

- 11 Alternative Money Systems (online)

- 12 Alternative Money Systems (physical)

- 13 Open loop and closed loop prepaid access

- 14 Alternative money exchanges

- 15 Books & Documentaries

- 16 Related Wikipedia articles

- 17 See also

- 18 Attachments

The term price system is used to describe any economic system whatsoever that effects its distribution of goods and services by means of goods and services having prices and employing any form of debt tokens, or money. Except for possible remote and primitive communities, all modern societies use price systems to allocate resources. However, price systems are not used for all resource allocation decisions today. A variety of non-market economics type proposals have been presented as alternatives to a price system such as energy accounting.

A price system may be either a fixed price system where prices are set by a government or it may be a free price system where prices are left to float freely as determined by unregulated supply and demand. Or it may be a combination of both with a mixed price system.

Yes, Banks DO Create Money Out Of Thin Air!

Under the current fractional reserve banking system, banks can loan out many times reserves. But even that system is being turned into a virtually infinite printing press for banks.

Germany’s central bank – the Deutsche Bundesbank (German for German Federal Bank) – has also admitted in writing that banks create credit out of thin air.

If you’re still not convinced that banks create money out of thin air, without regard to whether or not they have deposits on hand, please note that the Fed has said as much.

| Printing money out of thin air does not increase wealth, it only increases claims on existing wealth. | |

| — Charles Hugh Smith |

| Banks do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers’ transaction accounts. | |

| — 1960s Chicago Federal Reserve Bank booklet, "Modern Money Mechanics" |

| Based on how monetary policy has been conducted for several decades, banks have always had the ability to expand credit whenever they like. They don’t need a pile of “dry tinder” in the form of excess reserves to do so. That is because the Federal Reserve has committed itself to supply sufficient reserves to keep the fed funds rate at its target. If banks want to expand credit and that drives up the demand for reserves, the Fed automatically meets that demand in its conduct of monetary policy. In terms of the ability to expand credit rapidly, it makes no difference. | |

| — William C. Dudley, President and Chief Executive Officer of the Federal Reserve Bank of New York, speech in July 2009 |

| The Federal Reserve believes it is possible that, ultimately, its operating framework will allow the elimination of minimum reserve requirements, which impose costs and distortions on the banking system. | |

| — Ben Bernanke, February 10, 2010 - proposal for the elimination of all reserve requirements |

| When a bank makes a loan, it simply adds to the borrower’s deposit account in the bank by the amount of the loan. The money is not taken from anyone else’s deposit; it was not previously paid in to the bank by anyone. It’s new money, created by the bank for the use of the borrower. | |

| — Robert B. Anderson, Secretary of the Treasury under Eisenhower, August 31, 1959 |

| Do private banks issue money today? Yes. Although banks no longer have the right to issue bank notes, they can create money in the form of bank deposits when they lend money to businesses, or buy securities... The important thing to remember is that when banks lend money they don’t necessarily take it from anyone else to lend. Thus they create it. | |

| — Congressman Wright Patman - House Committee on Banking and Currency, 1964 |

| The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. | |

| — Sir Josiah Stamp, president of the Bank of England in the 1920s |

| Banks create money. That is what they are for... The manufacturing process to make money consists of making an entry in a book. That is all... Each and every time a Bank makes a loan... new Bank credit is created — brand new money. | |

| — Graham Towers, Governor of the Bank of Canada from 1935 to 1955 |

And much more additional proof can be found here. The source of this information came from an excellent article at globalresearch.ca here. And highly recommended also is Steve Keen's book Debunking Economics.

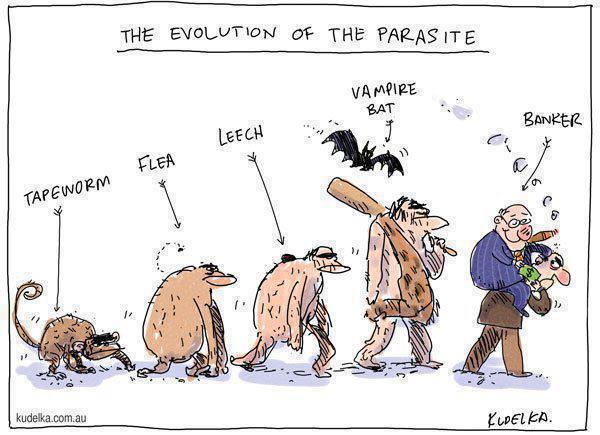

Why is this money-out-of-thin-air fact so important?

Even if banks don’t really loan based on their deposits and reserves, who cares? Why is this such a dangerous myth?

Because, if banks don’t make loans based on available deposits or reserves, that means:

- This was never a liquidity crisis, but rather a solvency crisis. In other words, it was not a lack of available liquid funds which got the banks in trouble, it was the fact that they speculated and committed fraud, so that their liabilities far exceeded their assets. The government has been fighting the wrong battle, and has made the economic situation worse.

- The giant banks are not needed, as the federal, state or local governments or small local banks and credit unions can create the credit instead, if the near-monopoly power the too big to fails are enjoying is taken away, and others are allowed to fill the vacuum.

Indeed, the big banks do very little traditional banking. Most of their business is from financial speculation. For example, less than 10% of Bank of America’s assets come from traditional banking deposits.

More quotes about the financial system

| By this means government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft. | |

| — John Maynard Keynes |

| If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon. It is so important that our present civilization may collapse unless it becomes widely understood and the defects remedied very soon. | |

| — Robert H. Hemphill, Credit Manager of the Federal Reserve Bank of Atlanta |

| If our Nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good also makes the bill good. The difference between the bond and the bill is that the bond lets money brokers [Bankers] collect twice the amount of the bond plus interest. Whereas the bill [currency] pays nobody but those who contribute directly in some useful way. The People are the basis for government credit. Why then cannot the people have the benefit of their own credit by receiving non-interest bearing currency, instead of Bankers receiving the benefit of the people's credit in interest bearing bonds? It is absurd to say that our country can issue $30 million in bonds and not $30 million in currency! Both are promises to pay: but one promise fattens the usurers and the other helps the people. | |

| — U.S. President Thomas Jefferson

|

| With adequate knowledge of the physical realities that dominate the economic affairs of peoples, the road is clear for unlimited progress and the attainment of universal peace and prosperity. The evils that in the past have paralyzed the very heart of nations lie patent and beyond concealment. So they pass beyond the power of further harm. Only that rarest kind of courage—intellectual fearlessness and honesty to face things as they are and not as they appear—is required to abolish poverty and economic degradation from our midst. | |

| — Wealth, Virtual Wealth and Debt, by Frederick Soddy

|

| A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men ... We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world — no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of small groups of dominant men. | |

| — Woodrow Wilson, 1916

|

| As a result of the war, corporations have been enthroned and an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until wealth is aggregated in the hands of a few and the Republic is destroyed. I feel at this moment more anxiety for the safety of my country than ever before, even in the midst of the war. | |

| — Abraham Lincoln

|

| Fiat money is the cause of inflation, and the amount which people lose in purchasing power is exactly the amount which was taken from them and transferred to their governments by this process. | |

| — G. Edward Griffin, The Creature from Jekyll Island

|

| A fiat monetary system allows power and influence to fall into the hands of those who control the creation of new money, and to those who get to use the money or credit early in its circulation. The insidious and eventual cost falls on unidentified victims who are usually oblivious to the cause of their plight. This system of legalized plunder (though not constitutional) allows one group to benefit at the expense of another. An actual transfer of wealth goes from the poor and the middle class to those in privileged financial positions. | |

| — Congressman Ron Paul, Paper Money and Tyranny

|

| It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. | |

| — Henry Ford

|

| It is commonly supposed that a banker's profits consist in the difference between the interest he pays for the money he borrows and the interest he charges for the money he lends. The fact is that a banker's profits consist exclusively in the profits he can make by creating and issuing credit in excess of the liquid assets he holds in reserve - and in exchange for debts payable at a future time" | |

| — H. Hd. MacLeod, :The Theory and Practice of Banking

|

| If debt and money are the units of measure by which we account for and keep track of the production and distribution of physical wealth, then surely the units of measure and the reality being measured cannot be governed by different laws... If [physical] wealth cannot grow at compound interest, then debt should not either. | |

| — Frederick Soddy 1877-1956

|

| Mr. Chairman, we have in this Country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks, hereinafter called the Fed. The Fed has cheated the Government of these United States and the people of the United States out of enough money to pay the Nation's debt. The depredations and iniquities of the Fed has cost enough money to pay the National debt several times over... This evil institution has impoverished and ruined the people of these United States, has bankrupted itself, and has practically bankrupted our Government. It has done this through the defects of the law under which it operates, through the maladministration of that law by the Fed and through the corrupt practices of the moneyed vultures who control it. | |

| — Rep. Louis T. McFadden, US House of Representatives 1932 |

| The colonies would gladly have borne the little tax on tea and other matters had it not been that England took away from the colonies their money, which created unemployment and dissatisfaction. The inability of the colonists to get power to issue their own money permanently out of the hands of George III and the international bankers was the prime reason for the Revolutionary War. | |

| — Benjamin Franklin from his Autobiography |

| Today, the acceptance of fiat money — currency not backed by an asset of intrinsic value — rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold. | |

| — Alan Greenspan, here |

The Nature of Money & Credit

(from Wikipedia:Social Credit)

Major Douglas also criticized classical economics because it was based upon a barter economy, whereas the modern economy is a monetary one. To the classical economist, money is a medium of exchange. This may have once been the case when the majority of wealth was produced by individuals who subsequently exchanged it with each other. But in modern economies, division of labour splits production into multiple processes, and wealth is produced by people working in association with each other. For instance, an automobile worker does not produce any wealth (i.e., the automobile) by himself, but only in conjunction with other auto workers, the producers of roads, gasoline, insurance etc.

In this view, wealth is a pool upon which people can draw, and the efficiency gained by individuals cooperating in the productive process is known as the “unearned increment of association” – historic accumulations of which constitute what Douglas called the cultural heritage. The means of drawing upon this pool are the tickets distributed by the banking system.

Initially, money originated from the productive system, when cattle owners punched leather discs which represented a head of cattle. These discs could then be exchanged for corn, and the corn producers could then exchange the disc for a head of cattle at a later date. The word “pecuniary” comes from the Latin “pecus,” meaning "cattle". Today, the productive system and the distributive/monetary system are two separate entities. Douglas demonstrated that loans create deposits, and presented mathematical proof in his book Social Credit.

Douglas believed that money should not be regarded as a commodity but rather as a ticket, a means of distribution of production "There are two sides to this question of a ticket representing something that we can call, if we like, a value. There is the ticket itself – the money which forms the thing we call 'effective demand' – and there is something we call a price opposite to it." Money is effective demand, and the means of reclaiming that money are prices and taxes. As real capital replaces labour in the process of modernization, money should become increasingly an instrument of distribution.

Douglas also claimed the problem of production, or scarcity, had long been solved. The new problem was one of distribution. However; so long as orthodox economics makes scarcity a value, banks will continue to believe that they are creating value for the money they produce by making it scarce. Douglas criticized the banking system on two counts:

- for being a form of government which has been centralizing its power for centuries, and

- for claiming ownership to the money they create.

The former Douglas identified as being anti-social in policy. The latter he claimed was equivalent to claiming ownership of the nation. Money, Douglas claimed, was merely an abstract representation of the real credit of the community, which is the ability of the community to deliver goods and services, when, and where they are required.

Monetary reform

The Problem of Usury

Profit and interest should be kept within the realm of personal agreements and not be part of the system itself otherwise it takes on the power of money creation and can gain control over its value.

In a serious consideration of the subject therefore it is necessary to particularise carefully. Jeffery Mark saw this clearly and in his Analysis of Usury (Dent. 1935) (p26) he distinguished a major and a minor variety, thus;

there are two forms of usury. the major form is that represented by bank loans and the discounting of bills, and the minor form by the creation of interest bearing savings, investments, or inheritances, which as government or municipal stock, industrial shares, bonds, debentures, mortgages, or capital claims on land, plant and property, make up the debt structure in every country. The common and essential feature in all these processes, here comprehended as the major and minor principles of usury, is the payment of money interest on money lent.

... we must always differentiate between lending by private persons and lending by banks or other credit making institutions. In the later case they create the means of payment out of nothing and then proceed to appropriate both capital and interest.

Here's an excerpt from an article by Trace Mayer on 24hgold.com: The usurer has lent his money to one who takes it of his own free will, and can then enjoy the use of it and relieve his own necessity with it, and what he repays in excess of the principal is determined by free contract between the parties. But a prince, by unnecessary change in the coinage, plainly takes the money of his subjects against their will, because he forbids the older money to pass current, though it is better, and anyone would prefer it to the bad; and then unnecessarily and without any possible advantage to his subjects, he will give them back worse money …. In so farthen as he receives more money than he gives, against and beyond the natural use of money, such gain is equivalent to usury; but is worse than usury because it is less voluntary and more against the will of his subjects, incapable of profiting them, and utterly unnecessary. And since the usurer’s interest is not so excessive, or so generally injurious to the many, as this impost, levied tyrannically and fraudulently, against the interest and against the will of the whole community, I doubt whether it should not rather be termed robbery with violence or fraudulent extortion.

Distribution of Wealth

Usury is often considered the root of the problem, but it is a logical necessity within the context of a system in which money is a scarce commodity. Money should not be something scarce, with very few people having an abundance while the majority is short of it. This is because it should play the role of the "ticket" by which resources are distributed throughout the system. A system which is properly designed to organise the global allocation of resources amongst all its parts would ensure that all of the members composing it be in an optimal state of well-being. To do otherwise would be equivalent to an organism preventing its blood from flowing to some parts of its own body.

Universal Basic Income

This ties in to the UBI ideas via the redeemable bond associated with each person. Technically, the UBI is not a hand-out, but rather a dividend on each persons share of the total wealth of the nation (in this case the "nation" being the network). This approach also avoids the severe problem of giving the state the power to engage in plunder using the law, which is a problem since it is a violation of peoples liberty.

- Wikipedia:UBI

- UBI New Zealand

- Keith Rankin on UBI

- Resource for Rankin papers

- Philosophy conversation on UBI

Internal Memo from the Bank of England 1862 to the Banks of America

The sender may distribute material via email and Web site without profit to those who have expressed a prior interest in receiving it for research and educational purposes only. I believe that this constitutes a fair use of any copyrighted material as provided for in Title 17 U.S. Code, Section 107. If you desire to use copyrighted material from this source for purposes that go beyond the fair use statutes, you must obtain permission from the copyright owner.

In 1862 the creditors of America, the Bank of England, sent the following circular to every bank in New York and New England:

"Slavery is likely to be abolished by the war power. This, I and my European friends are in favour of, for slavery is but the owning of labour and carries with it the care of the labourer, while the European plan, led on by England, is for capital to control labour by controlling the wages. This can be done by controlling the money. The great debt that capitalists will see to it is made out of the war must be used as a means to control the volume of money. To accomplish this, the bonds must be used as a banking basis. We are now waiting for the Secretary of the Treasury to make the recommendations to Congress. It will not do to allow the greenback, as it is called, to circulate any length of time, as we cannot control that."

"When through a process of law the common people have lost their homes, they will be more tractable and more easily governed by the strong arm of the law, applied by the central power of wealth, under the control of leading financiers. People without homes will not quarrel with their leaders. This is well known among our principal men now engaged in forming an IMPERIALISM OF CAPITAL TO GOVERN THE WORLD. Thus by discreet action we can secure for ourselves what has been generally planned and successfully accomplished."

That was part of a leaflet called the "Bankers' Manifest" printed for private circulation among leading bankers only. It appeared in 1934.

While on the subject of banks and debts, it is evident considering their nature that the banks are more powerful than the Government of the United States, for if they were not, there would: be no such thing as a National Debt. National debts are unnecessary in a country with the real and potential wealth and resources as the United States; they are the greatest of national burdens and the evils the Government would be foremost in avoiding. But on the other hand they are the biggest source of riches and control in the hands of the American financial system. That we have a National Debt is not only evidence of the real rulers of the nation, but the extent of the debt is a true indication of the extent of this rule.

It is absurd that the Government should be forced to borrow that which it has, under the Constitution, the power to create!

Ever since the banks were given the right to issue money, panics, financial depressions, famines, and the inevitable increase of crime have been periodic occurrences. In America the average is about every twelve years. They shall continue until the government assumes its natural prerogative of issuing money, and confining the work of bankers to banking.

Excerpts from the book: Citadels of Chaos 1949.

BRICS & SCO

- 2015-01-12: All about the SCO

- 2014-07-21: Refusing to share: How the West created BRICS New Development Bank

- 2014-07-15: BRICS establish $100 billion bank and currency reserves to cut out Western dominance

- 2013-10-09: What will happen to global economy if BRICS announce launch of new currency - Bricso? - and part 2

Related news & views

- 2015-01-15: Lagarde said Swiss central bank did not warn IMF of Franc/EUR cap removal

- 2015-01-05: WTF is Citi doing with hugely increasing derivatives exposure?

- 2015-01-03: Jim Willie: It's game over for the dollar

- 2015-01-01: There is no recovery from Americas economic extinction-level event - about the derivatives system

- 2014-12-31: The Rigging Triangle Exposed: The JPMorgan-British Petroleum-Bank Of England Cartel Full Frontal

- 2014-12-30: The Netherlands planned to introduce a new currency in 2012

- 2014-12-10: The World on the Verge of Another Financial Crisis - the sum total of the world's debts can never be repaid

- 2014-11-21: Gold Repatriation Stunner: Dutch Central Bank Secretly Withdrew 122 Tons Of Gold From The New York Fed

- 2014-11-07: UK parliament to debate money creation for the first time in 170 years

- 2014-11-06: The $9 Billion Witness: Meet JPMorgan Chase's Worst Nightmare

- 2014-10-06: SWIFT Sanctions Statement

- 2014-10-03: Russia ratifies Economic Union and readies trade in currencies other than dollar

- 2014-10-01: Chinese renminbi becomes directly tradable with the euro

- 2014-09-28: As the Fed's secrets are revealed, will the world turn to Bitcoin?

- 2014-09-26: Derivatives Bubble Burst Part II: Coming Soon to a TBTF Bank Near You

- 2014-08-24: How a Reserve Currency, Such As the US Dollar, Dies…Slowly at First, Then All At Once

- 2014-06-18: London Takes Lead Seizing on China’s Yuan Push as Trading Starts

- 2014-04-05: The truth is out: money is just an IOU, and the banks are rolling in it - the Bank of England's dose of honesty throws the theoretical basis for austerity out the window

- 2014-01-27: HSBC Bank on Verge of Collapse: Second Major Banking Crash Imminent

- 2013-12-04: Yet another massive nail in the dollar’s coffin - Memorandum of Understanding signed by representatives of the Singapore and Hong Kong Exchanges

- 2013-12-04: EU fines 8 major banks record 1.7 billion euros for illegal rates rigging

- 2013-12-04: Yuan outperforms euro, becomes 2nd most popular trade finance currency

- 2013-10-15: Some interesting facts about money and debt

- 2013-10-10: Goldman "Whistleblower" Sues NY Fed For Wrongful Termination

- 2013-10-10: International Bretton Woods meeting about global currencies

- 2013-04-25: Everything Is Rigged: The Biggest Price-Fixing Scandal Ever

- 2013-03-29: FDIC & Bank of England Create Resolution Authority for Unlimited Cyprus-Style “Bail-Ins” for TBTF Banks!

- 2013-03-18: And the first haircut goes to... Cypress!

- 2013-01-28: Why Has Iceland Experienced a Strong Economic Recovery after Complete Financial Collapse in 2008?

- 2013-01-21: The Real Reasons Why Germany Is Demanding that the U.S. Return Its Gold

- 2012-09-21: China Launching Gold Backed Global Currency

- 2012-09-12: Reserve Bank sticks to its guns on new bank capital rules - time for a haircut?

- 2012-09-02: Audio interview about gold from allocated accounts missing

- 2012-09-01: China Launching Gold Backed Worldwide Currency

- 2012-08-16: Soros Unloads All Investments in Major Financial Stocks; Invests Over $130 Million In Gold

- 2012-08-11: Gauss virus targets

Alternative Money Systems (online)

- Bitcoin - digital money system with no central authority for regulation of money creation

- Open Transactions - a digital system of financial instruments which may soon be backed by bitcoins

- Loom

- Truledger

- WebFunds - a system based on the Ricardian Contract

- Voucher Safe

- A web-based currency called Ripple is in development

- RipplePay

- Mutual Credit - Drupal module

- GSF System

- Open Coin

- Cyclos - gaining a lot of popularity in Greece

- P2P Energy Economy

- Producia: Building a New Economy

- BIBO currency - bounded input, bounded output

Alternative Money Systems (physical)

- PostiveMoneyNZ

- PostiveMoneyUK

- American Monetary Institute

- The Cascadia Hours Exchange

- Ubuntu Contributionism

- Lawful Bank

- Ithaca Hours

- Time Banks - the unit of currency is one hour of time, and everyone’s time is valued equally

- The Open Money Projects

- SIMEC Interest-free community currency

- SeedBomb! - seeding Vancouver's first community currency

- CommunityForge

- Electricity as the universal basis for a new money system - Activist Post

- kilowattcards.com - Kilowatt Cards are gift cards that pay for 10 kilowatt-hours of electricity (including taxes and fees) to benefit any consumer electricity account when redeemed.

- Dutch barter system challenges the banksters

- Pat Conaty - Fast Money, Slow Capital

Open loop and closed loop prepaid access

"Bitcoin is an open loop prepaid access; that’s classified as “Money” in the states. If you’re curious, in the USA, it’s perfectly legal to buy and sell open loop prepaid access, and use it in barter for other things." [1]

- http://www.wavecrest.gi/services/open-closed-loop-Prepaid-Payments.html

- Definitions and Other Regulations Relating to Prepaid Access (FinCEN)

- Financial Crimes Enforcement Network; Amendment to the Bank Secrecy Act Regulations – Definitions and Other Regulations Relating to Prepaid Access (FinCEN)

Alternative money exchanges

Books & Documentaries

- Inside Job

- The Secret Of Oz - Bill Still

- Human Ecology

- Social Credit

- The Money Fix

- Sacred Economics - by Charles Eisenstein

- What Is Money? - by Frederic Bastiat

- Professor Steven Keen's Youtube channel

- What Has Government Done to Our Money? - Murray N. Rothbard

- Economics in One Lesson - Henry Hazlitt

Related Wikipedia articles

- Money

- Currency

- Currency competition

- Legal tender

- Unit of account

- Medium of exchange

- Ecological economics

- Environmental economics

- Energy accounting

- Price system

- Technocratic views of the price system

- Free banking

- Full-reserve banking

- Anonymous internet banking

- Ripple monetary system

See also

- Gold & silver

- The State

- Who Owns The Federal Reserve? - the Fed is privately owned. Its shareholders are private banks - Ellen Brown

- The Thrive Movement's economy sector

- The Origins of Government Paper Money - by Murray N. Rothbard, March 01, 2011

- States to Financially Break Away from Federal Government

- Comparison of payment systems

- How to Create a Local Free Market Currency - (DownsizeDC) with several links to other good articles :

- A lot of detailed information - by William F Hummel

- Online transaction systems

- Anatomy of a future-proof local currency system

- fee.org - The Foundation for Economic Education

- P2P foundation's article on money

- WeBank - Report organised by Nesta and OpenBusiness.cc about P2P finance

- Post scarcity

- Cancerous Capital

- transaction.net

- The Natural Economic Order - The full text of the book by Silvio Gesell

- Understanding money supply - Mike Shedlock (Mish)

- What is Money and How Does One Measure It? - Mish

- 50 Statistics About The U.S. Economy That Are Almost Too Crazy To Believe

- Myths about "what's economically important"

- In This Age of Plenty - Social Credit book by Louis Even

- Thirst for Justice - The Social Credit island metaphor, by Louis Even

- The end of the Statist Quo - by Casey Research

- How To Attack The Fiat Currency Fractional Reserve Banking Conspiracy

- Conspiracy of the Rich - by Robert Kiyosaki (Rich Dad, Poor Dad) - a book collaboratively created on a wiki

- Competing Currencies Can "End the Fed" Softly - Ron Paul on the House floor introducing his bill for legalizing competing currencies, the HR 4248 Free Competition in Currency Act of 2009

- Does Economic Growth Cause Inflation? - by Frank Shostak Published: March 23rd, 2011 - an indispensable expose on flawed monetary policy and an important reference for maintaining stability of alternative currencies

- Russia Today - Zeitgeist: Moving Beyond Money

- kleptocracy.us - visualising the US debt (and this one too)

- About the ESF

- MarketSkeptics - reporting about the real state of the economy

- Bernard Lietaer: Money diversity (TEDtalks) - Bernard Lietaer argues that the monoculture of money is what creates economic instability, leading to liquidity crises. He calls for a greater diversity of alternative currencies

- Creating Wealth - by Gwendolyn Hallsmith & Bernard Lietaer - Scientific proof that multi-tier currency systems are absolutely required

- Do We Need Banks, Or Can We Cut Out the Middleman?

- The Sustainable Scale Project - We must recognize the earths limited capacity to provide for us

- Class Action Lawsuit Against The Federal Reserve

- Derivatives: The Unregulated Global Casino for Banks - excellent illustrated insight into just how much is at stake

- Excellent summary of big bank's crimes

- Think Your Money is Safe? Think Again: The Confiscation Scheme Planned for US and UK Depositors

- Public banking in Costa Rica

- The economics of Star Trek

- The ONE Revelation about HFT Programs that Truly Scares Bankers (Hint: It's About Gold & Silver)

- What is the petrodollar?

- Why can't China just dump it's US treasuries now?